If you’re one of many VeVe users who’ve bought low and sold high when it comes to digital collectibles, you’re probably wondering how you change those gems into currency and back into your bank account. While the process is still in the beta phase, the Payout feature is now in place.

What is the Payout Feature?

The Payout is a system that allows you to withdraw your Gems from your VeVe wallet, and back into your bank account as fiat (e.g. USD). In order to use this feature, you will be required to complete KYC (Know Your Customer), and be approved, before you can make any withdrawals.

Information you submit for the KYC approval is securely stored by our MTL partner — BlueSnap. BlueSnap is a global payment gateway and merchant account provider, offering financial services and payments in over 200 regions and 47 countries.

How to Use the Payout Feature

1. Log in to the VeVe web wallet

The VeVe Payout feature is only available through the VeVe web wallet, which can be found at https://omi.veve.me/

To log in, simply use the same email account and password that you use to log into your VeVe app. You will be sent a 2FA email to complete the sign-in process after which you will see your Gem and OMI wallets and balances.

Below your wallet balances, you will find the ‘Payout’ button. Initially, this button will be inaccessible/greyed out to most Collectors, so please remain patient if you cannot access this feature yet.

Reminder: Always use a STRONG password to protect your assets. If you have not changed/updated this password for a while we strongly recommend taking this opportunity to do so.

2. Complete KYC

KYC or ‘Know-Your-Customer’ regulations require you to provide identification documents in order to complete a financial transaction. Processing a payout transaction on VeVe is no different, and you will be required to complete this process before you can withdraw.

Completing VeVe KYC is a relatively straightforward process. You will need to enter your personal information. You will also need to provide some preliminary details (the ID number) for ONE piece of government-issued identification:

When you’re ready to proceed simply hit ‘begin KYC process’ to begin entering your information.

During this step, you only need to enter the number associated with your chosen form of ID. If you are a US citizen you will be asked for the last 4 digits of your social security number.

BlueSnap will then contact you via the email address you provided to request the actual ID document. This email will contain a link to take you to a secure portal to upload your identity verification.

Note: Please do not enter a country code for your phone number.

3. Enter Payout Method

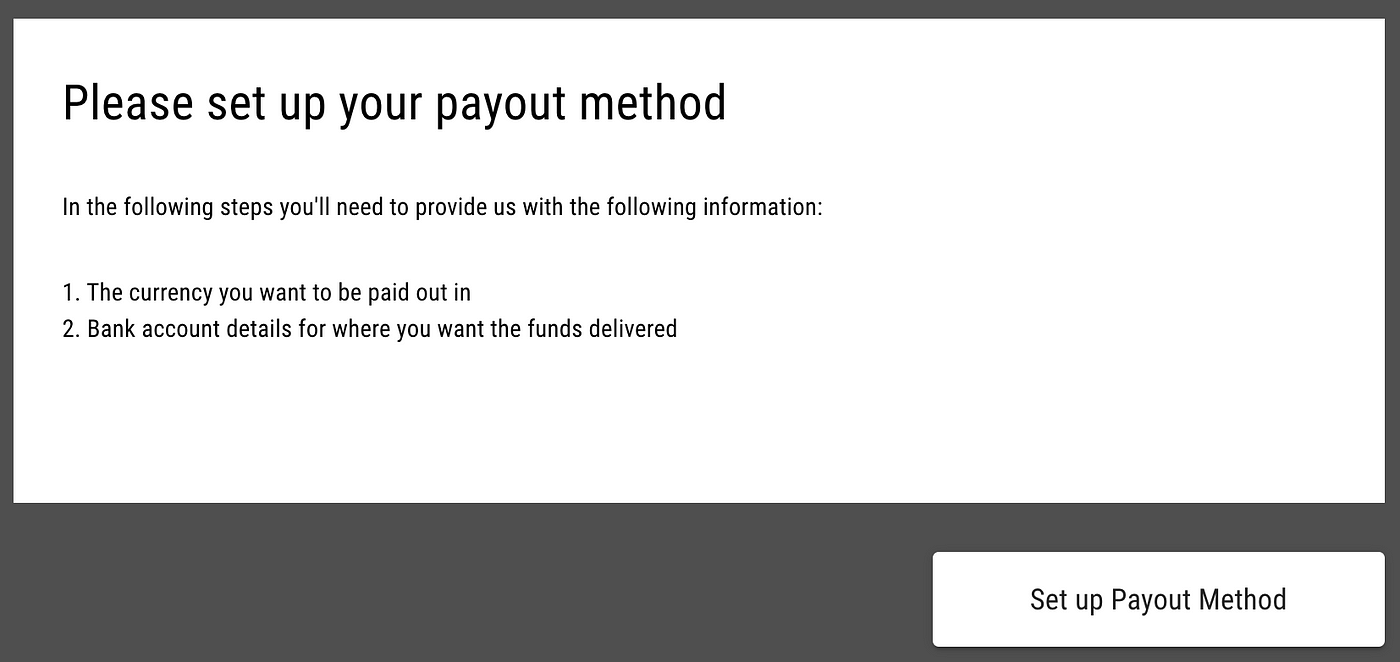

Once you have submitted your personal details and ID number you will be taken to the Payout Method screen.

Here you will enter your base currency and the bank account details where you wish to receive your Payout. At the time of writing, you can opt to receive AUD, CAD, EUR, GBP, HKD, JPY, NZD, and USD.

I Don’t Use These Currencies, Can I Still Use The Payout?

If your home currency is not one of the currencies listed you can still use the Payout feature, however, we recommend contacting your bank to ensure they can perform the currency conversion for you and deposit your local currency into your account as normal.

In the majority of cases selecting USD will be the most appropriate option for you, as it is accepted by most banks, and in most countries. Again, please contact your financial institution to confirm that you will receive your Payout, and to understand the fees they may charge for this service.

Once you have submitted your personal and banking details you will see that your KYC application is pending. You will then receive an email from our MTL provider requesting your proof of identity documentation, and proof that you control the bank account that you have provided details for.

This email will contain a link to a secure upload facility, to maintain the security of your information. When opening any links please double-check that it has come from BlueSnap and that you are indeed taken to a secure site.

What if I Want to Change My Banking Details?

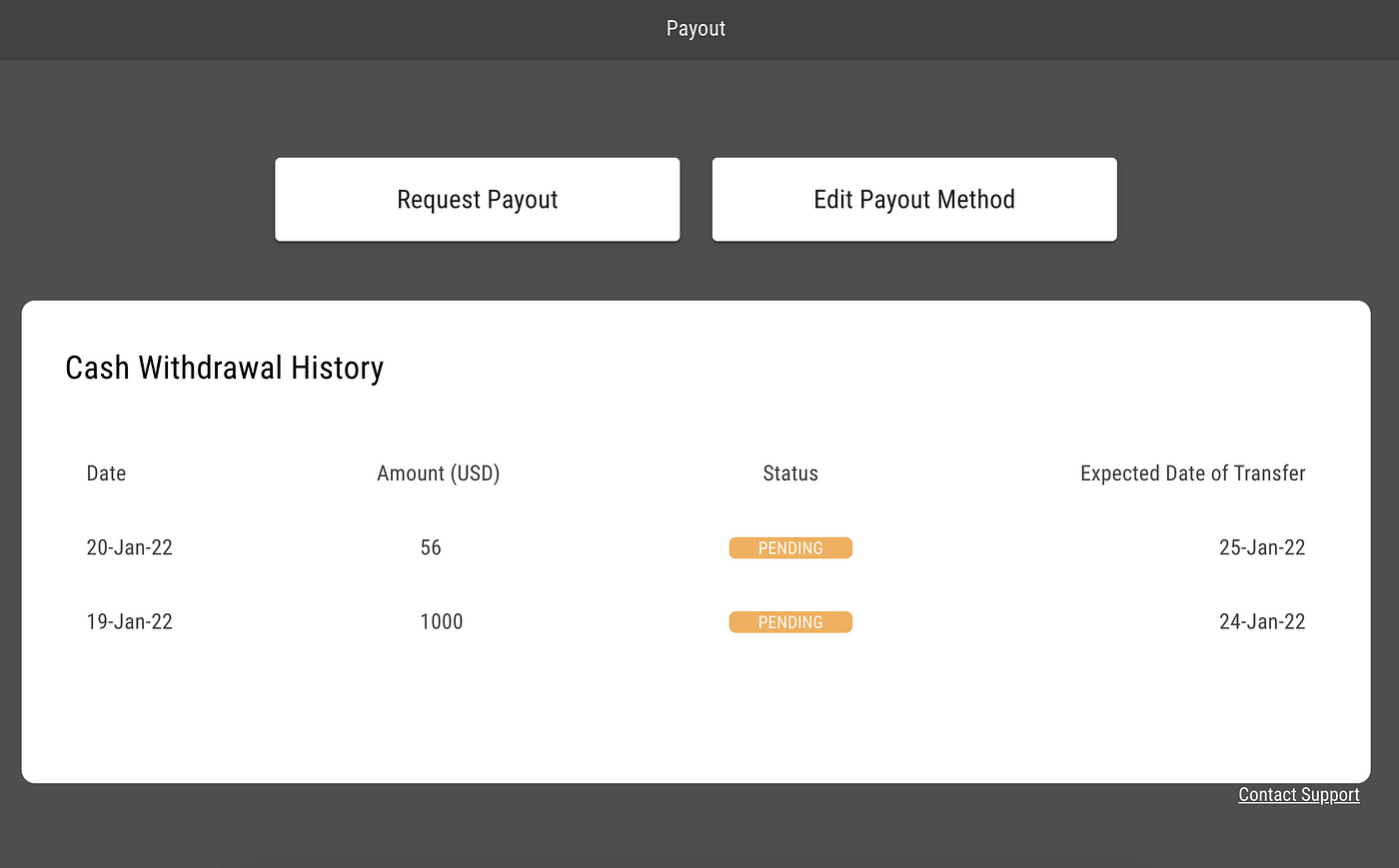

Once your KYC application has been approved you can change your banking details at any time by tapping the ‘Edit Payout Method’

The process is the same as the initial setup, and again our MTL provider will contact you for proof/verification of the new banking details.

How Long Does KYC Approval Take?

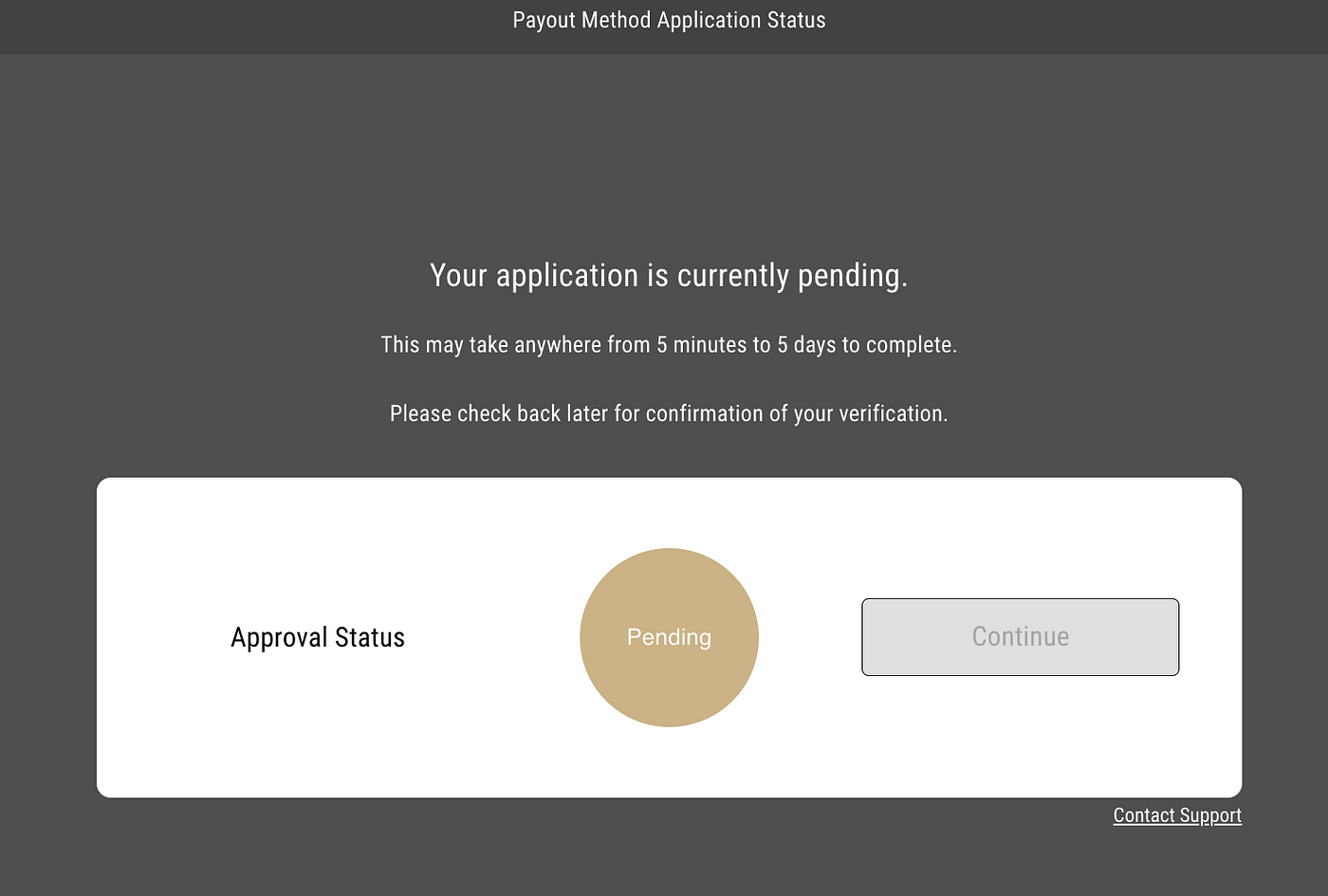

Once you have submitted your information you should expect our MTL provider to make contact within the next 5 business days requesting your documents for verification. Once provided they will either approve or deny your KYC application. In the meantime, you will see the ‘pending’ screen below.

Once approved, the ‘pending’ status will update to ‘approved’ and you can proceed to the Payout request screen by tapping ‘continue.’

4. Request a Payout

Once your KYC application has been approved you can proceed to request a Payout. To do this now or in the future, simply hit the ‘Payout’ button again on the web wallet home screen, and you’ll see the Payout home screen below.

Here you can request a new payout, edit your payout method, and view your withdrawal history. Assuming your payout details are up to date, simply tap the ‘Request Payout’ button to get started.

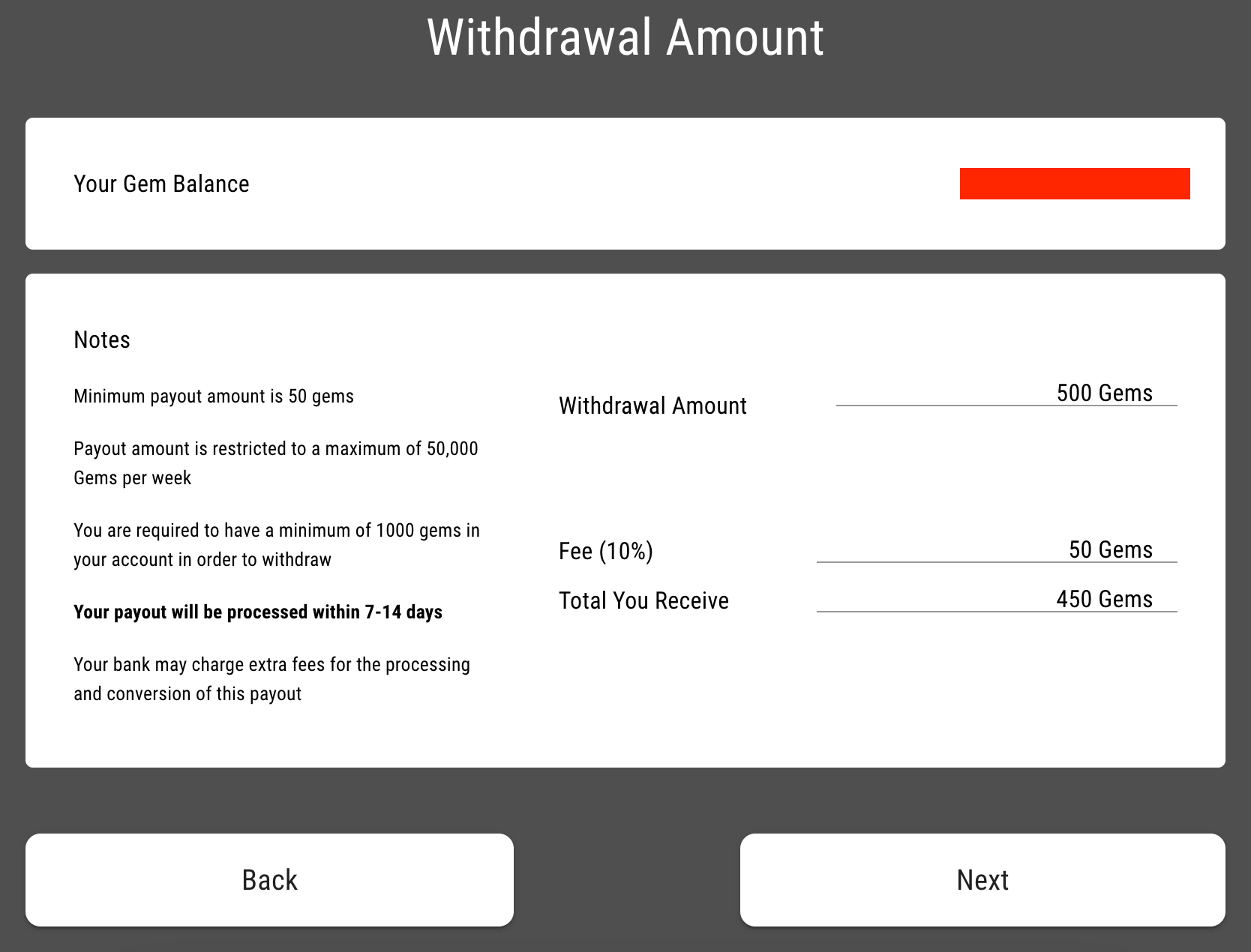

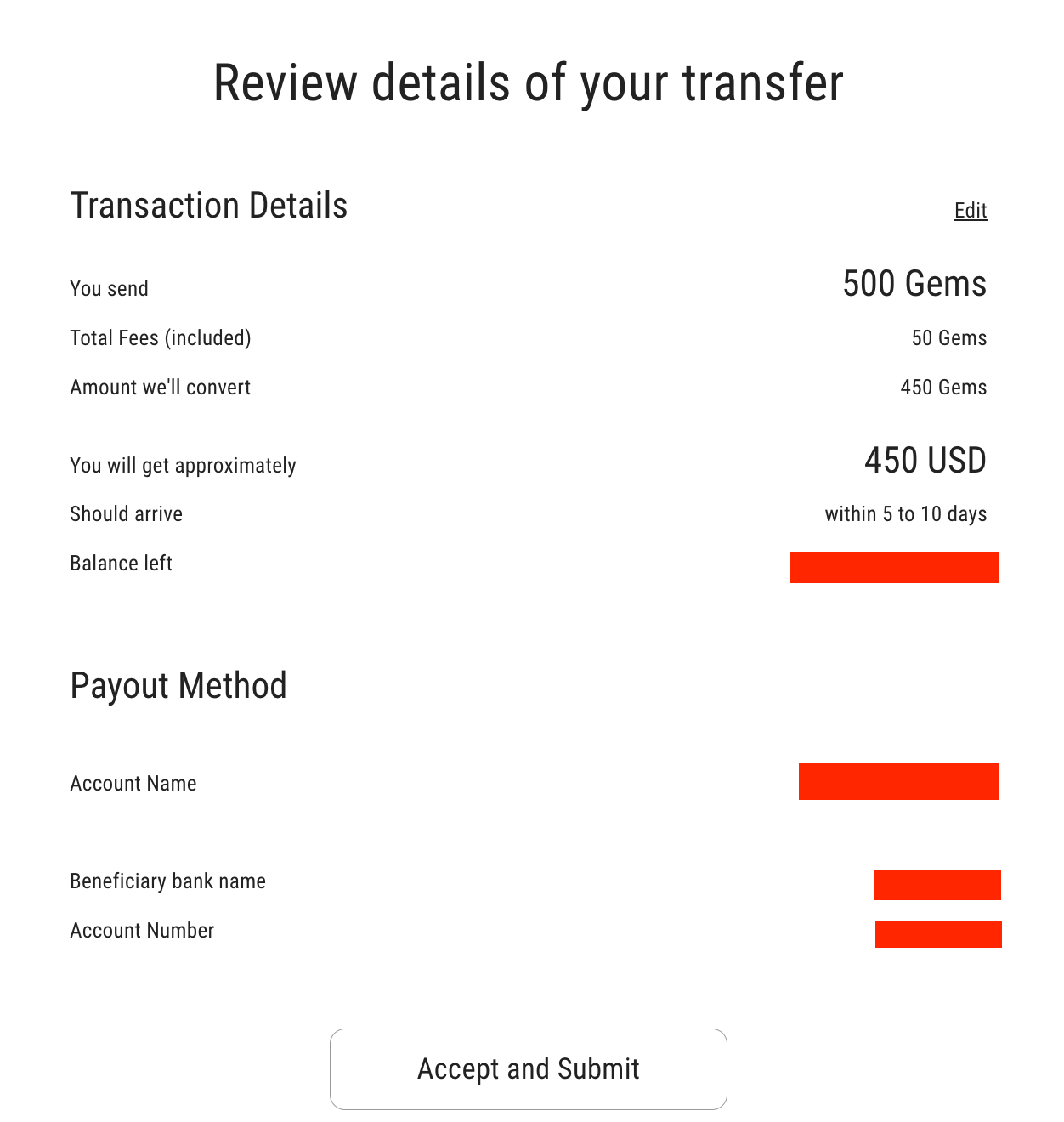

Then, enter the number of Gems you would like to withdraw, up to a maximum of 50k Gems. This screen will also detail the fees (10% per transaction) and the total value in Gems that you will receive.

Tap ‘next’ to continue, and you’ll be presented with a final confirmation screen. If you are happy with the details, tap ‘accept and submit’ to process your Payout.

Note: Payout requests will be processed within 5 business days, and can take up to 15 days from that point to arrive in your account. You will see either ‘complete’ or ‘pending’ when your withdrawal has been processed.

Fees and Withdrawal Times

There are a few numbers to be aware of when processing a Payout. These details are also given to you when making your Payout request.

It is also likely that your bank will also impose an incoming wire transfer fee, as is typical of international/SWIFT network transactions. This is typically around $35 USD, and you may also be charged a currency conversion fee if applicable.

Please contact your nominated bank ahead of time to determine which fees you should expect. To be clear, this figure is determined and charged by your banking institution, not VeVe.

FAQ

Restricted Countries

There are some restrictions on some countries due to international regulations and sanctions. These are no different from those imposed by ordinary financial institutions (and in most cases, crypto exchanges). A full list of currencies/countries that are supported by BlueSnap can be found here.

Why Don’t I have Access?

The Payout feature is a new integration and is currently in beta. To ensure adequate testing of the Payout it will be rolled out to small groups to begin. We will progressively open access to larger batches of collectors, and eventually all users, when our testing parameters have been satisfied. Please stay tuned to our socials for more updates!

Can I Payout in Any Currency?

The Payout supports the following major currencies AUD, CAD, EUR, GBP, HKD, JPY, NZD, and USD.

If you don’t use one of these currencies you can still use the Payout, however, you will need to check with your bank/financial institution ahead of time to ensure they can perform the conversion to your local currency.

Changing Bank Details

You can change/update your banking details at any time by tapping the ‘Edit Payout Method’ button. You will need to provide verification documents proving ownership of said account each time you change your details.

Can I Request More Than One Withdrawal at a Time?

Yes, as long as the total amount does not exceed 50,000 Gems in 7 days.

Issues with KYC

Any issues in providing ID verification or KYC approvals need to be directed to BlueSnap support. VeVe does not hold, store or have any access to the information you are providing, nor are we the final arbiters of these decisions.

Fee Comparison

There are a number of company incurred costs associated with an international Payout feature, and the 10% fee charged is in line with these costs, and similar platforms. For example, eBay charges a minimum fee of 12.55% on sales up to $7500 in value, and an additional 2.35% on any portion over $7500.

Similarly, platforms like Etsy charge a 20 cent listing fee for any item and a 5% transaction fee. Should your listing be found and purchased as a result of their 3rd party advertisements (known as an offsite ad fee) you will also be charged an additional 15% on the value of the items sold.

Via this site.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that EcomiCrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and EcomiCrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.