Crypto ETFs are making their way into the big-time investment circles, and Schwab is becoming a player. Blockchain has been dealing in the crypto ETF field for some time now, and has become well-known as a leader in that specific field. But what are blockchain ETFs?

Blockchain

First a bit about Blockchain. Blockchain is a decentralized, incorruptible digital ledger that facilitates and records all kinds of transactions. The collective ledger is updated every time a transaction occurs, and the data is synchronized across the network of participants, ensuring transparency and trust. The information in the blockchain is not stored in any single location, but is rather distributed and copied across a network of computers and other devices. This means that the records on the blockchain are public, verifiable and accessible by anyone who has internet.

The technology vaulted to fame with the advent of Bitcoin, but the technology has expanded beyond just cryptocurrencies. Blockchain ETFs have the potential to benefit from the increased adoption and utilization of blockchain technology. Blockchain ETFs are funds that meet at least one of the following two criteria:

- They are funds that invest in companies involved with the transformation of business applications though development and use of blockchain technology.

- They are funds that invest in futures and options pegged to the performance of Bitcoin, Ether and other cryptocurrencies, or in cryptocurrency investment products offered by asset managers like Grayscale or Bitwise.

Click on the tabs below to see more information on Blockchain ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. By default the list is ordered by descending total market capitalization.

As of 08/01/22

Blockchain ETFs Traded in US

This is a list of all Blockchain ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. If you’re looking for a more simplified way to browse and compare ETFs, you may want to visit our ETF Database Categories, which categorize every ETF in a single “best fit” category.

* Assets in thousands of U.S. Dollars.

|

Symbol

|

ETF Name

|

Asset Class

|

Total Assets ($MM)

|

YTD Price Change

|

Avg. Daily Volume

|

Previous Closing Price

|

1-Day Change

|

|---|---|---|---|---|---|---|---|

| BLOK | Amplify Transformational Data Sharing ETF | Equity | $598.96 | -45.26% | 331,908.0 | $21.99 | 0.96% |

| BLCN | Siren ETF Trust Siren Nasdaq NexGen Economy ETF | Equity | $133.84 | -34.08% | 36,910.0 | $27.80 | -0.54% |

| LEGR | First Trust Indxx Innovative Transaction & Process ETF | Equity | $122.61 | -17.63% | 12,549.0 | $35.19 | 0.89% |

| BITQ | Bitwise Crypto Industry Innovators ETF | Equity | $70.01 | -62.45% | 152,910.0 | $7.89 | 1.28% |

| BKCH | Global X Blockchain ETF | Equity | $61.68 | -67.74% | 163,476.0 | $6.99 | -1.13% |

| DAPP | VanEck Digital Transformation ETF | Equity | $34.24 | -66.26% | 117,608.0 | $6.26 | 1.13% |

| KOIN | Capital Link Global Fintech Leaders ETF | Equity | $18.84 | -19.96% | 2,146.0 | $34.56 | 0.82% |

| BITS | Global X Blockchain & Bitcoin Strategy ETF | Multi-Asset | $8.85 | -57.57% | 11,937.0 | $8.30 | 0.97% |

Schwabb Goes Crypto ETF

Charles Schwab

Not to be left behind, Charles Schwab announces its first crypto-related ETF launch, set for August 4th

Schwab Asset Management, a subsidiary of The Charles Schwab Corp., announced last week the launch of the Schwab Crypto Thematic ETF (NYSE Arca: STCE), calling the new product “its first crypto-related ETF.”

Charles Schwab is a major American brokerage, banking, and financial services company. Schwab Asset Management has over $655 billion in assets under management as of March 31, according to its website. It is the third largest provider of index mutual funds and the fifth largest provider of exchange-traded funds (ETFs).

The first day of trading for the Schwab Crypto Thematic ETF is expected to be on or about Aug. 4, the announcement details, adding:

The fund is designed to track Schwab Asset Management’s new proprietary index, the Schwab Crypto Thematic Index.

According to the fund’s prospectus filed with the U.S. Securities and Exchange Commission (SEC) Friday, the Schwab Crypto Thematic ETF is “designed to deliver global exposure to companies that may benefit from the development or utilization of cryptocurrencies (including bitcoin) and other digital assets, and the business activities connected to blockchain and other distributed ledger technology.” Furthermore, “The fund is non-diversified, which means that it may invest in the securities of relatively few issuers,” the company warned.

The announcement notes:

The fund will not invest in any cryptocurrency or digital assets directly. It invests in companies listed in the Schwab Crypto Thematic Index.

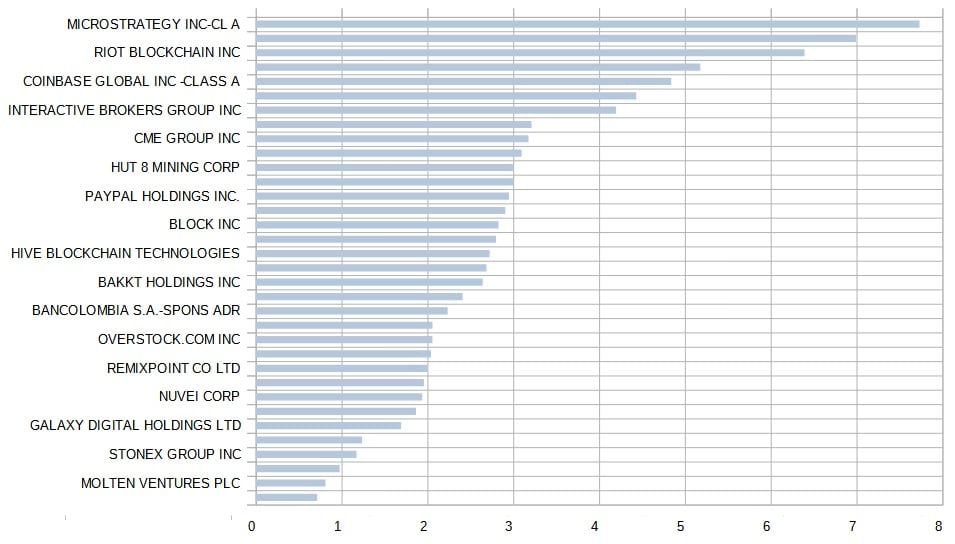

The Schwab Crypto Thematic Index’s constituents as of July 29 include Microstrategy, Marathon Digital Holdings, Riot Blockchain, Silvergate Capital, Coinbase Global, Robinhood Markets, Interactive Brokers, Nvidia, CME Group, Bitfarms, Hut 8 Mining, International Exchange, Paypal, SBI Holdings, Block Inc., Monex Group, Hive Blockchain, Internet Initiative Japan, Bakkt Holdings, NCR Corp., and Bancolombia.

David Botset, managing director and head of Equity Product Management and Innovation at Schwab Asset Management, commented:

The Schwab Crypto Thematic ETF seeks to provide access to the growing global crypto ecosystem along with the benefits of transparency and low cost that investors and advisors expect from Schwab ETFs.

Meanwhile, the SEC still has not approved a bitcoin spot ETF despite approving several bitcoin-futures ETFs. In June, Grayscale Investments, the world’s largest digital asset manager, filed a lawsuit against the SEC after the securities regulator rejected its application to convert its flagship bitcoin trust, GBTC, into a spot bitcoin ETF.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that EcomiCrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and EcomiCrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.