There has been a great deal of speculation about today’s bear market and how it compares to those markets of the past. Most agree crypto has hit a bear market, but with enough differences in circumstances to have a substantial influence on the outcome.

Altcoin Sherpa’s Viewpoint

A widely followed analyst and trader says that the crypto market could copy its 2018 playbook.

2018 Market Similarities

Pseudonymous trader Altcoin Sherpa tells his 175,700 Twitter followers that this year “could very well” turn out to be a repeat of 2018 with a few differences with regard to infrastructure and diversity of digital assets.

“2022 could very well look like 2018 given the amount of time we could chop around for. I do think that the market is more mature these days than before, though. Overall market structure for trading is better + dexes [decentralized exchanges] + NFTs [non-fungible tokens] + gaming + new usable chains.”

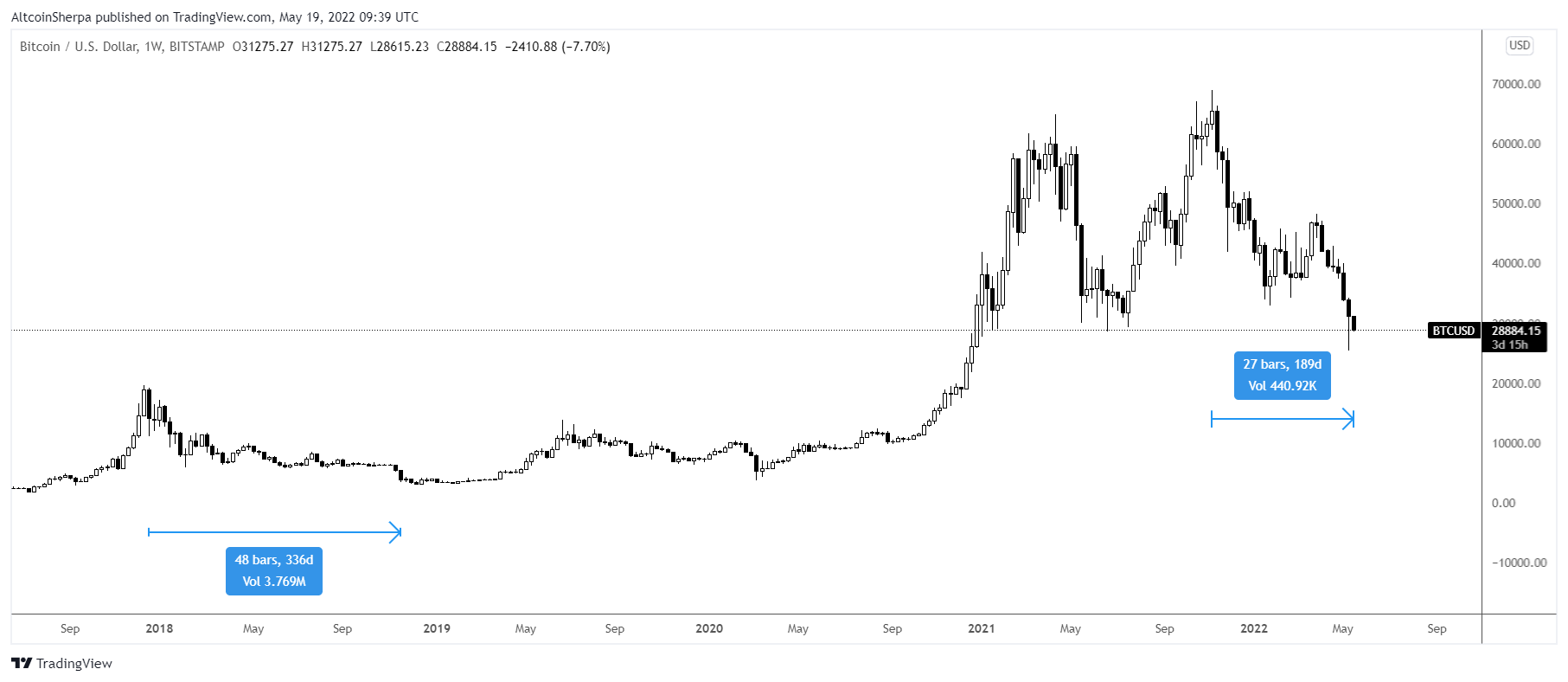

According to Altcoin Sherpa, Bitcoin (BTC) took 336 days in 2018 to hit a bottom after reaching a 2017 high, while altcoins took longer.

The crypto analyst and trader says that since Bitcoin hit the all-time high in November of 2021, roughly 189 days have passed, or about half the time it took for the flagship cryptocurrency to bottom out during the 2018 bear season.

“BTC: One thing that sucked about 2018 was the amount of time it took to drawdown; we’re about halfway there right now.

If you count altcoin/BTC pairs, it was even longer. 2019 was shit for many of those (alt/BTC pairs were more popular back then).”

The pseudonymous crypto analyst says Bitcoin could appreciate by over 15% from current levels before crashing.

“Something like this would make sense for me; more people getting bullish on the bearish retest of $35,000 – $40,000 and then price nuking lower.”

Bitcoin is trading for $29,504 at time of writing.

Why the 2022 Bear is Different

The big picture: The crypto market is still very new. There are risks and shaky technologies, many of which are failing in spectacular attention-grabbing fashion this week. But at the same time, the industry is on firmer footing today than it was in 2018’s Crypto Winter, the last bear market.

- A bear market is traditionally thought of as a time when an asset trades below its prior high by 20% or more, usually accompanied by a lot of pessimism about the near-term future.

- But this is a nonsensical way to think about crypto. A 20% drop could be just a weird Tuesday.

Nevertheless, we may have arrived at bear. The mood needs to shift, and we might be there.

- Bitcoin has fallen to less than half of its most recent all-time high of $69,045 from Nov. 10. That alone is probably enough to call this a bear, but if it goes below $20,000 (the prior bull’s all-time high), that will be symbolically powerful.

But in crypto, it’s not truly a bear market until there are real consequences, such as:

- Funds close,

- Startups shutter or

- “Established” crypto companies start announcing layoffs

Be smart: This is where things are different this time. Billions of dollars are committed to building out the industry. Just this year, venture funds with over a billion dollars under management have been announced, including Haun Ventures, Electric Capital, Andreessen-Horowitz‘s new fund, FTX Ventures and others.

- That’s enough to launch many companies as well as shore up their best bets in rough times.

Brady’s thought bubble: Crypto will not be “dead” after a severe downturn, but it might drop out of the national conversation again. Regardless, the sector will carry on.

- One of these days, something will get folks excited again, and the market will perk back up.

2018

Context: In 2018, the bear market kicked in when word started going around that the U.S. Securities and Exchange Commission was knocking on the doors of startups funded by initial coin offerings (ICOs).

- Back then, it was hard to buy anything but bitcoins with dollars. So eager investors bought bitcoins, traded them for ethers, and then bought into ICOs. That drove up the price for everything.

- Demand for ICOs was basically the whole demand for cryptocurrency, so when it dried up, the whole industry dried up.

2022

Today, there’s no such clear single cause, in part because the cryptocurrency market has more use cases and more operational companies now.

- Having learned from 2018, crypto companies have been prepared.

- As early as 2021, projects started hedging their volatile treasury holdings by shifting part of their funds into dollar-backed stablecoins, so they could ride out a downturn.

The bottom line: Bear markets are familiar. No one likes them, but they come often enough that the established leaders know how to ride them out.

Disclaimer: Although the material contained in this website was prepared based on information from public and private sources that EcomiCrush.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and EcomiCrush.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.